This project offers several methodological contributions in the area of macro-finance: both in terms of theory and empirics. The overarching theme is that certain questions about the role of financial intermediation and financial frictions can be answered without relying on specific microfoundations. Instead, the relevant characteristics of financial intermediaries can be described in terms of observable sufficient statistics.

We will provide a general framework that nests a large class of models of financial intermediation. We will use data on prices and quantities of assets to estimate the elasticities of asset supply and demand using the Granular Instrumental Variable approach. Our estimates will allow us to derive prescriptions regarding policies that work through asset markets, formulated in terms of observable returns and estimated elasticities - an optimal financial index. Finally, we will contribute to the debate about the importance of risk and liquidity premia in the determination of asset prices. Ultimately, we will contribute not only to academic debate but will also provide valuable guidance to policymakers.

This project is located at the frontier of macro-finance research. All working packages provide innovations in the literature both in terms of the research question and in terms of methodology. We will provide a flexible interface to study the role of financial frictions in shaping macroeconomic responses to policies, study properties of a large class of models belonging to our framework, and incorporate aggregate risk into sequence space. All new methodological contributions will be made publicly available in terms of data and codes to ensure replicability and encourage further research in the area.

-

Jak powinna zachowywać się polityka pieniężna w warunkach niepewności? Sprawdza Piotr Żoch w cyklu GRAPE | Tłoczone z danych dla Dziennika Gazety Prawnej.

-

Yu-Ting Chiang i Piotr Żoch pokazują w REStud, że w szerokiej klasie modeli makroekonomicznych, elastyczność podaży płynności jest metryką dostateczną.

-

Dlaczego banki centralne muszą być ostrożne w swoich decyzjach? Sprawdza Piotr Żoch w cyklu GRAPE | Tłoczone z danych dla Dziennika Gazety Prawnej.

-

We are very excited to share that Karol Bednarski joins the team of our ...

-

W jaki sposób percepcja polityki monetarnej kształtuje reakcje rynków, sprawdza dla DGP Anatol Roettke.

Źródło finansowania | Financing: Narodowe Centrum Nauki, OPUS

Projekt realizowany | Timeline: 06/2025 -- 05/2029

Kierownik | Principal Investigator: Piotr Żoch

Budżet łączny | Total budget: 794 916 zł

- wynagrodzenia dla podstawowych wykonawców | compensation to researchers: 284 000 zł

- stypendia dla młodych badaczy | scholarships for young scholars: 200 000 zł

- komputery i oprogramowanie | hardware and software: 30 000 zł

- konferencje i inne wyjazdy | conference travels: 94 740 zł

- materiały, dane i usługi obce | data, usables and outsourced services: 129 908 zł

- koszty pośrednie dla FAME | overheads for FAME: 130 314 zł

|

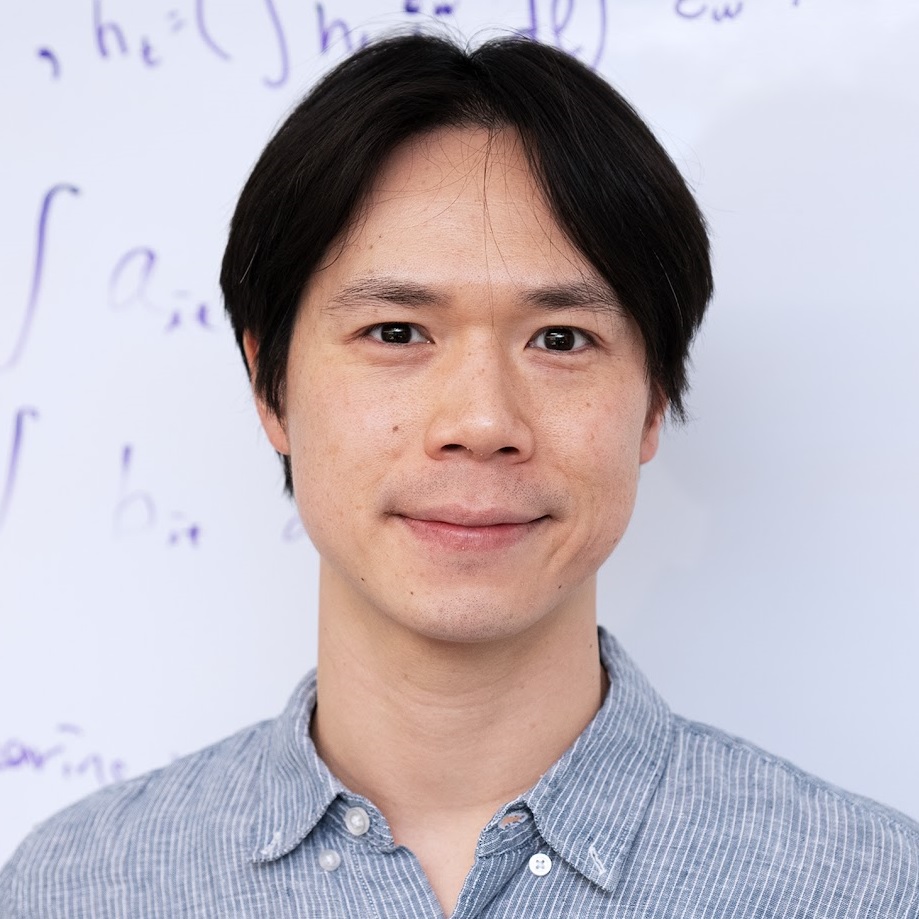

Yu-Ting Chiang, Federal Reserve Bank of St. Louis Yu-Ting studies how information and financial frictions affect macroeconomic dynamics and policies. |

W toku | Work in progress

-

Optimal asset market operations Przeczytaj streszczenie | Read abstract

We characterize governments' optimal responses to asset market disturbances across a broad class of models with financial frictions. We show that the Ramsey plan can be achieved by a policy rule targeting a specific relationship between asset returns, regardless of the underlying disturbances. This relationship is determined by asset supply and demand elasticities that can be estimated empirically with standard identification strategies. Absent financial frictions, the optimal policy stabilizes spreads across all assets. However, in the presence of financial frictions, the optimal rule prescribes time-varying spreads to facilitate financial intermediation. We apply our framework to study the optimal design of asset purchase and lending programs, as implied by key empirical estimates of asset supply and demand elasticities.